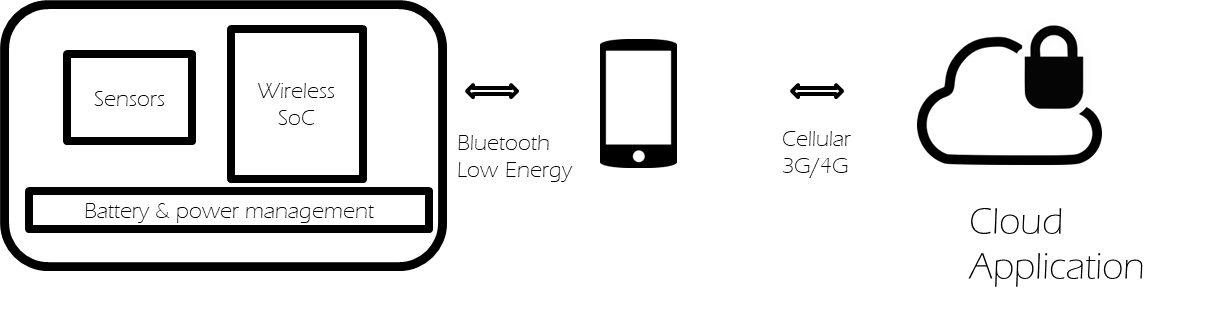

This article reviews the issues when considering the choice of radio technologies when building Internet of Things systems. Our previous article proposed there were two radio technology selections to be made:

- An ultra-low power technology to connect sensor nodes with gateway nodes to enable battery powering for ultra small devices.

- A longer range technology to connect gateway nodes with the internet.

Ultra low power radio technologies

Given that a typical sensor node will be battery powered without re-charge over a period of the order of years, there is massive requirement for an extremely low power solution. Several radio technologies have been developed with this application in mind – of particular note Bluetooth Low Energy and Zigbee/Thread.

The case for Bluetooth is built on the universal availability of this standard in smart phones so allowing these devices to act as either gateways to cloud application, control points for the IoT system or data aggregation/display nodes for non-cloud connected cases.

The case for Zigbee and its Thread variant is built on their optimised design for connecting sensors and particularly their ability to create a mesh network which potentially extends the effective operating range of a gateway node.

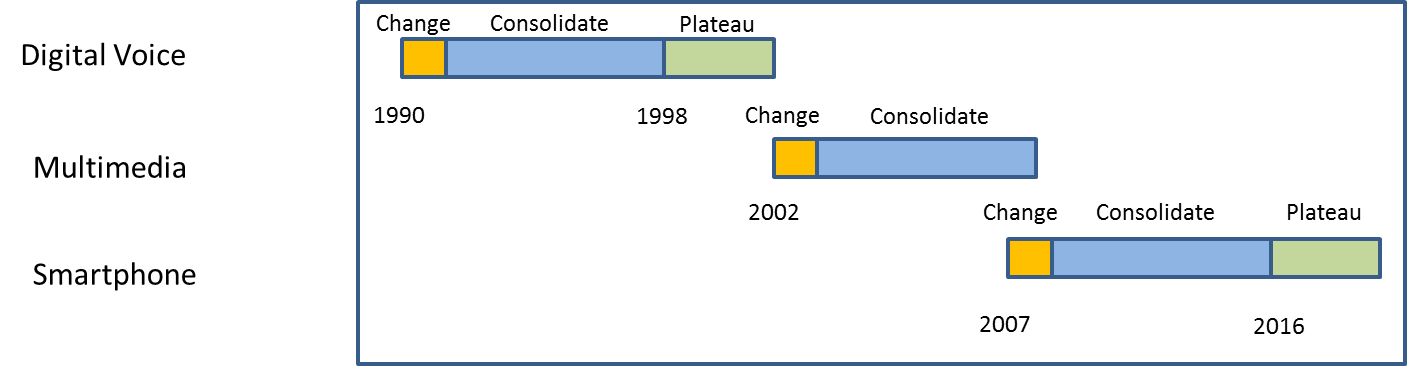

Bluetooth SIG is aiming to close these functional gaps in the Bluetooth 5 release which is due late 2016 early 2017, promising in addition to mesh networking increased range. Timing is often critical for the process of choosing winning technical standards, but in this case it seems the whole IoT market has been dormant in a state of great expectation already for a number of years and therefore not a critical issue for Bluetooth.

Ultimately the winning radio standard in this case is likely to be decided by the role of the smart phone in the IoT ecosystem – if it plays an important role then Bluetooth solutions will dominate, if not then it is likely there will be less consolidation into a single radio type.

Longer range radio technologies

For the RF connection between the gateway node and the ‘internet’, the availability of a local WLAN network has typically between the key factor driving choices as a Wi-Fi signal will usually mean lower costs and power consumption than using cellular. Indeed, Ericsson has estimated that nearly 90% of IoT devices will NOT be connected over cellular. However 5G is being designed with IoT in mind and therefore it may offer a more cost effective and robust communication solution than today’s cellular solutions, yet expectations are that this technology will not be widely available until after 2020*.

Long range IoT is currently dominated by a number of proprietary solutions such as SigFox and LoRa which have emerged to fill a gap of combining long range and low power. The price of this combination is to really cutback on data rates offered to a single node, which suits a lot of the contemporary machine to machine applications. Because of the very low bandwidth per node and their relatively long range, these solutions can be made to be a very economic solution for many applications.

Looking at past experience with mobile telephony, standardised radio solutions drive opportunities to create economies of scale and if operators create economic packages of IoT users then it is likely 5G will dominate in the long term.

*Verizon in the USA is aggressively driving 5G wireless trials and targets some early commercial deployments in 2017 for fixed site application i.e. fibre/cable replacement role, not mobility and not necessarily the scope of 5G required for lowest power IoT.