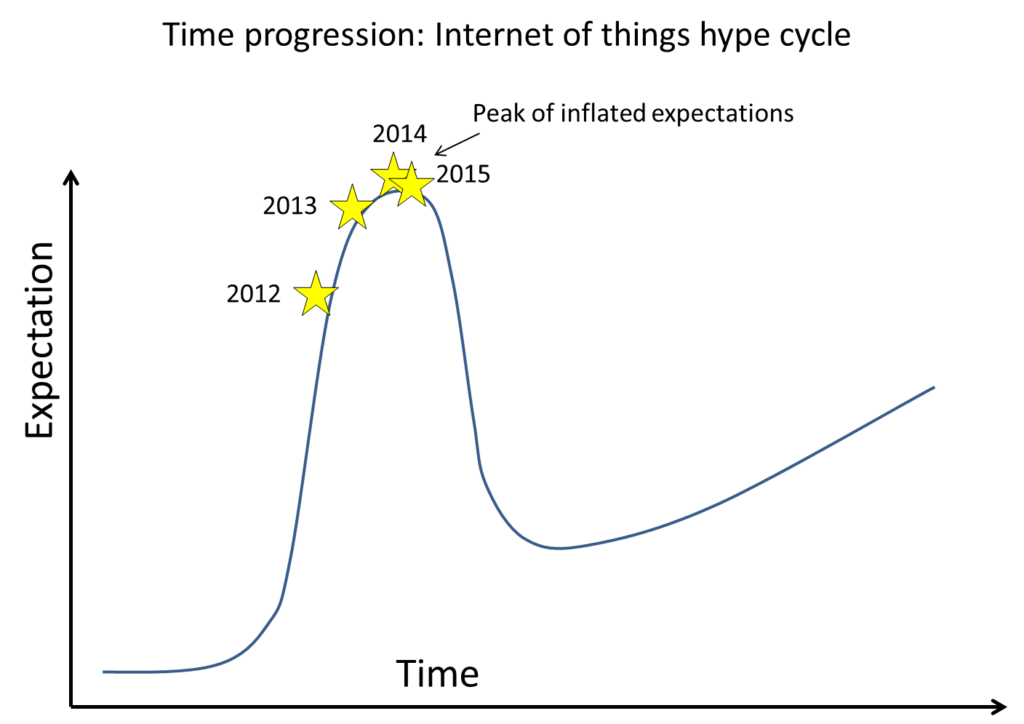

The Internet of Things (IoT) or Internet of everything, hereafter IoE, is an incredibly hyped phenomenon at present viz IoT/IoE at the peak of the hype cycle. Source: Gartner 2014, 2015.

Nevertheless, within the massively wide scope of IoE, there have been clear opportunities within selected verticals. Businesses have been deploying IoE like solutions to optimise their process and realise significant cost savings. The example I like best is “Enevo”, a Finnish company involved in waste management, often described as the “internet of shit”, which has helped waste collection companies save huge costs, circa 40% by optimising the frequency and routing of collections.

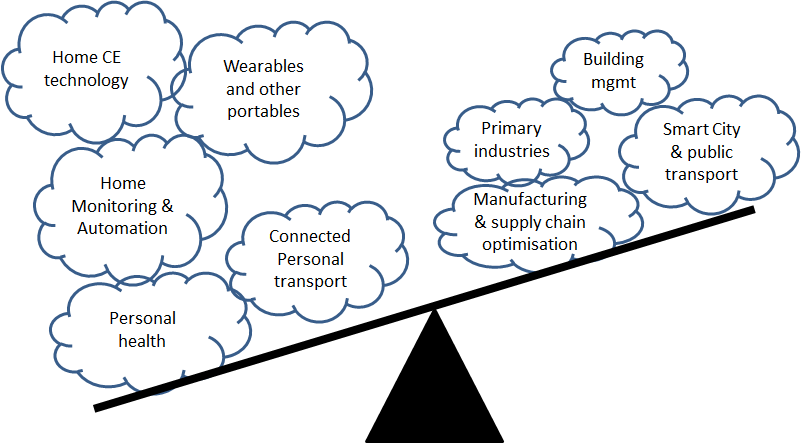

There are a wide range of industry sectors looking at IoE, but can we say that the offers and solutions really belong to the same stable, or are they so custom they should be viewed within their own silo? Right now, this situation reminds me somewhat of the “bowling alley phase” from Michael Moore’s book, “Inside the tornado” (successor book to “Crossing the chasm”). In this phase, solutions are highly customised around individual businesses’ needs and there is not a vanilla platform offer suitable for all. Happy to hear other opinions on this.

Switching tack to the consumer product angle, what potential product categories do we see where people are going to pay out for an IoE augmented experience? It is happening here:

- Personal monitoring/fitness e.g. fitbit, nike fuel,

- Home automation/optimization e.g. Mihome, Smartthings, Nest, Hive

- Personal heathcare/independence e.g. Kinetik, Acticheck

Of course there is then the catch all of the “closed loop” internet experience, embedded into part of an existing product category/product experience:

- Providing a basic service e.g. music/video/other digital goods delivery & consumption

- Providing feedback to the vendor or service provider of the product usage patterns and product maintenance/wear and tear e.g. Aviva drive car driving style, General motors Onstar

From a technical architecture point of view, when you consider the IoE across most of the categories, you are left with some common elements:

- A sensor for gathering data. Most often wireless for convenience & background operation.

- An aggregation point to bring together different sensor data streams and send to the internet. This could be a mobile phone or a home automation control hub.

- A Cloud platform for the capture, processing and provision of service for the system e.g. visualisation of data, providing recommendations, remote activation/update etc.

To this end, at All about the Product, we have decided to take a look at a few contemporary solutions for elements of the system, to build a solution and then get a sense of the different strengths of the various options for the system elements.

We will be posting more information about our IoE product and voyage in the coming weeks.