After largely disappearing from the mobile phone market following its acquisition by Microsoft, 2017 will see the re-emergence of the Nokia brand with products managed by HMD Global in partnership with FIH Mobile (part of Hon Hai Precision) and brand licensed from Nokia. As someone deeply involved with portfolio management at Nokia during the growth and glory days, I would like to take the opportunity to explore whether this is a good time for them to make a comeback?

In a previous blog I analysed the dynamics of the mobile phone market in terms of what facets of the overall business need to be optimised at a given point in time. In brief, my view is that the smart phone market has moved into a plateauing phase where the key strengths needed are brand, distribution and cost efficiency. So the question is whether this new Nokia set-up is well placed for this challenge?

First of all where is the Nokia brand today? Ten years ago Nokia was the leading mobile phone brand across the world except in North America, South Korea and Japan. This position had been built on fifteen years of growth – how much can this legacy be drawn on now? At its zenith Nokia stood for a perhaps contradictory combination of high technology and reliability – you could expect to get the very latest from Nokia and the products would be really tough in real life. The challenges of the 2008-2013 period largely stripped Nokia of the high technology association but today you still hear stories of how good and tough my Nokia was. The UK press has been full of stories about the resurrection for the 3310 over the last week, all very positive. So if I was to describe the Nokia brand today from a European perspective I would use words like: honest, tough and sentimental.

Distribution is the next major part of competing in today’s market scenario as with any fast moving goods business. Here HMD take responsibility for sales and FIH Mobile for manufacturing and logistics. This has the promise of being a good combination with a lot of personnel coming over from Microsoft devices business while FIH are of course a well-established world class manufacturer. Access to market in countries where operator distribution is critical will depend on the right deals being made but there is no obvious reason why this may not be the case. While a split company setup may struggle in a period where the market is changing fast with product innovation at the fore, since this is not the case at the moment there is no reason to believe this cannot succeed well.

Cost efficiency is the key to offering the value for money proposition essential in a plateauing market and in this case to compete against mainly Chinese companies which offer very keen price points. Clearly the advantage of the resonance of the Nokia brand will give the new venture an edge but as a challenger there can be no expectation of premium pricing at the beginning of sales. With the mobile phone chipset business dominated by only a few suppliers, the size of FIH/Hon Hai as a manufacturer will be important to get good pricing as well as the potential of Nokia branded goods making even a fraction of historical volumes.

So in a nutshell it would appear that the timing for a comeback looks good. Leaving re-entry any later would see the continuing in the decline of Nokia as a consumer brand – furthermore the operational mode of separate sales and manufacturing companies in partnership can work when product innovation is not the main route to success.

Category Archives: Portfolio Planning

Business transformation, meet product portfolio management..

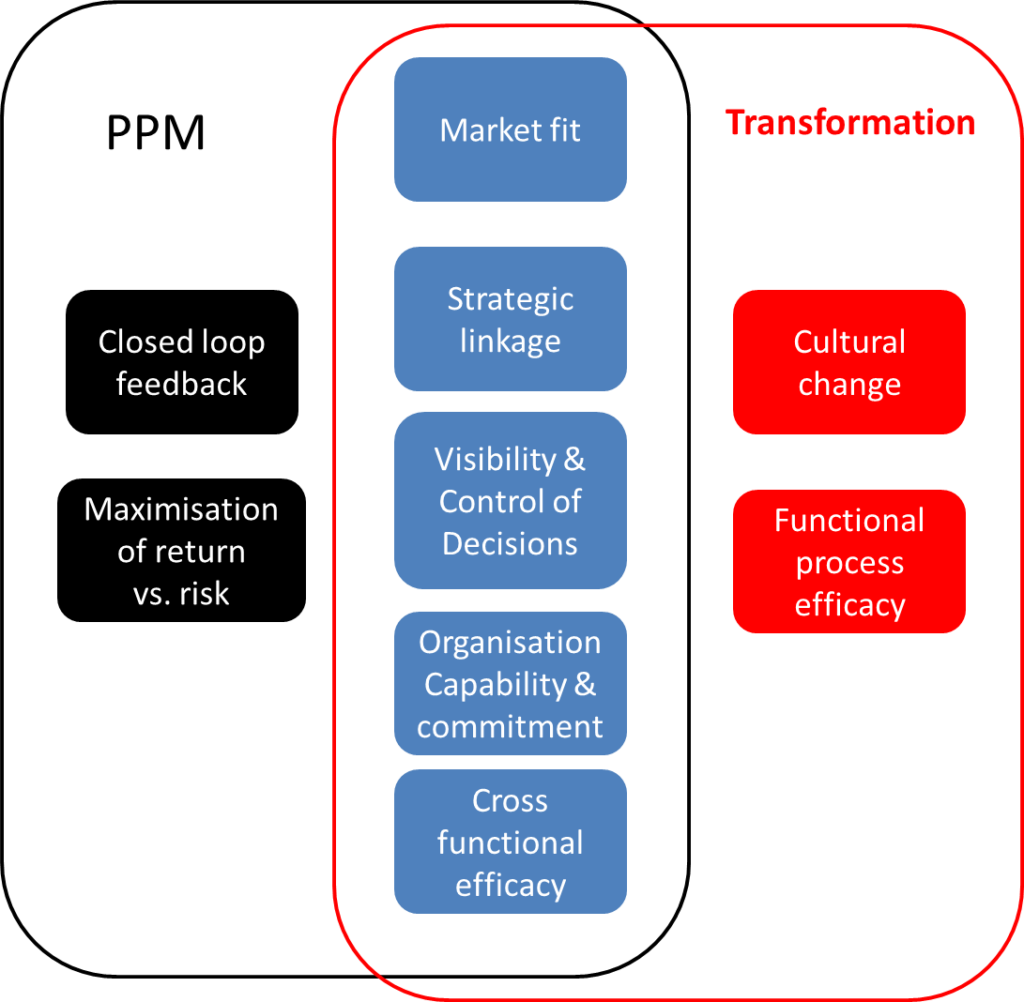

Business transformation is a much bandied term these days and in practice is often used to cover business change activities. This article is to make some comparisons between the goals & activities of transformation against those of a product portfolio planning and management process.

First, a reasonable definition of product portfolio management (PPM):

The process by which business strategy is converted into a product roadmap which delivers corporate goals and optimally utilises the business’ product making and marketing abilities in relation to the market opportunity.

Next, a couple of definitions for business transformation (BT):

- Business transformation is about making fundamental changes in how business is conducted in order to help cope with a shift in market environment.

- Business Transformation is a change management strategy which has the aim to align People, Process and Technology initiatives of a company more closely with its business strategy and vision.

In summary then, business transformation is an external market and business strategy driven process with the goal of creating change in the organisation to enable it to execute the business strategy and align it to compete in the new market reality. This is now sounding rather like the definition for product portfolio management…

So, are there any real differences between business transformation & PPM?

- Transformation scope covers situations where major cultural change is required

- PPM builds upon reasonably well working functional processes. Functional competence needs to be in good enough order for PPM e.g. functional capacity planning

- PPM has built-in “closed loop” feedback to adapt and sustain in the face of continued change as opposed to transformation which is about initiating & driving a big change

- PPM generates risk/return options for business decision e.g. between long and short term gain and taking technology risk or market risk or a balance of both.

If we were to try and make an analogy of personal health to these two approaches then business transformation “treatment” might be required in the most extreme situations to shock the patient to help them survive and then guide them toward a more healthy way of living. By contrast, PPM might be seen as a combined exercise and dietary approach which avoids the risk of extreme intervention and helps the person achieve their best health and fitness.

Personal reflection

In my own experience of working for a large corporate (Nokia) over many years, I have seen both transformations in action and then also contributed toward the formalisation of product portfolio management. My perception would be:

- The transformations galvanised the organisation into “change mode” and caused for example the creation of new business units with unique missions

- Whilst the initial phases of the transformation mostly bore fruit in line with their mission, often the nature of the transformation challenge could make the timing of the first fruit quite unpredictable

- Real value was only generated further through the transformation. This might be partly attributed to the benefits of the learning curve but the main value transition was co-incident with product portfolio management practices becoming bedded in

- The big value add of PPM was in its ability to hedge both technology risk through different delivery paths to market and market risk through an offering of mainstream and niche/discovery products.

I am interested to hear other views from others on PPM vs. business transformation, but for today, I am an advocate for benefits of PPM and indeed our company offers the Portgenie PPM framework to those interested in learning more.

References

[1] https://en.wikipedia.org/wiki/Business_transformation

[2] https://rapidbi.com/what-is-business-transformation-3/

[3]”Leading Change, Why Transformations Efforts Fail”, John P. Kotter, Harvard business Review.

When two worlds collide: Integrated Business Planning & Product Portfolio management.

As a long term practitioner of Product Portfolio Management (PPM), I was really interested to analyse the principles of Integrated Business Planning and compare it to the practises which I was familiar with. In the first place I must declare that in my career rather than labelling practices and processes, the modus operandi was to extend existing ways of working to become more holistic and drive higher overall business value. When looking at Integrated Business Planning, or IBP, I quickly recognised business processes which I had been operating for in excess of a decade.

The same problem from two different ends

The origins of Product Portfolio Planning lie in the desire to transform company strategy into an executable roadmap to deliver the corporate goals. In simple terms, it is about understanding the market opportunity and making decisions which maximally utilise the company’s ability to develop and market products. On the other hand, IBP was born from the world of Sales and Operations Planning (S&OP) which originated with the goal of balancing product sales and product manufacturing delivering the mantra of ‘one set of numbers’ – in other words, delivering operational excellence.

The collision between these two process philosophies is therefore natural once each has developed excellence in its original field of application: product sales performance is key intelligence for Portfolio Management whilst driving change in the selection of products is a key extension for S&OP.

The term, “Integrated Business Planning”, was originally coined by the consultants Oliver Wright who have a foundation in advising on S&OP. The aim of IBP is the integration of more company functions than S&OP, of particular relevance finance and product development, into a single regular planning cycle. The result being very similar to the regular cycles advocated in the portfolio management context.

A personal reflection

At Nokia in 2007 we implemented an organisational change which was characterised as an ‘integrated company’, the aim of which was to bring sales and operations into the same planning and decision making processes as product development. In reality this change had already started to happen ten years previously as operational excellence had developed as well as more structured product line management. Working in an integrated way had already become a way of life with functional decision taking a supporting role to the over-arching process driven, cross functional structures.

So overall it does not matter if the change to integrate a company into a common decision-making, shared-goal oriented organisation comes from S&OP or the Product Portfolio management end. Fundamentally, it makes sense for a company to operate as a single team which was our goal at All about the Product when we created our “Portgenie” Product Portfolio Management process framework.

In the end, so what?

You might accuse me of some bias, but my strongly held opinion is that there is no greater opportunity for medium and large scale businesses, than to look at how to jointly maximise product making and marketing capabilities in relation to market opportunities. Thus, I am really interested to hear the experiences of others in utilising IBP or PPM based approaches to deliver this benefit.

Prioritising development initiatives..part1

Part way through my career, I was asked to work on a change activity. One of its goals was to bring together the business priorities for a suite of about 100 software development initiatives which supported the end offering of products and platforms.

This was a great learning exercise, so part 1 of the post covers “what did I learn?”

Answer the “so what”?

Don’t invest too much time without first gaining a clear understanding of the purpose and intended outcomes from the exercise. Stakeholder contribution to this type of exercise is highly important and although I found stakeholders generally supportive, their main concerns were “What is going to happen in 1 week, 1 month or 6 months’ time as a result of this work?”

Be pragmatic

Projects and program briefs come in all shapes and sizes. Even with best intentions, the result is likely to be imperfect due to misunderstandings and the level of information available. By being pragmatic and giving fast feedback, the value obtained will track the 80/20 rule. As an example, it is very important to get the top 10 project rankings correct, but another thing entirely to try and fine tune project priorities lying in the 50th to 60th rankings.

Note, I am not suggesting there should be no clarifying dialogue between parties along the way, just that the act of providing the feedback ‘fast’ is a good way to flush out any major misunderstandings.

Decisions require preparation

It is hard to get time from senior stakeholders and harder still to sync their diaries to meet at the same time. A direct discussion of priorities is a challenge without having first developed the proper context. So, the approach for establishing priorities is likely to be an important point for the senior stakeholders along with the consequences of any decision options.

Therefore it is worth establishing a small core team to build and test a prioritisation framework and drive the significant ground work prior to any proposal. More on this in a later post.

Present versus future

“If we don’t secure today’s business then there is no tomorrow”. People tend to attribute higher value to items appearing in the immediate future rather than those slightly further away. This is natural and also a consequence of the time value of money or NPV. However, it is a bad sign when all risk and change gets pushed forward (delayed) further into the future. A balance is necessary and the core team should take care of the present vs. future investment balance according to the industry change clock cycle.

Prioritising development initiatives..part2

Part way through my career, I was asked to work on a change activity. One of its goals was to bring together the business priorities for a suite of about 100 software development initiatives which supported the end offering of products and platforms.

This was a historical exercise, but how might I approach matters now? With the benefit of hindsight, I would consider the approach:

- Establish a core team

- Map the projects to aid understanding

- Interpret the strategy to build a framework

- Make trial rankings and test result

- Prepare for the senior stakeholder review

1. Core team considerations

Fair representation of the business. Functional area owners want to be consulted on matters that impact on their responsibility areas. If you require strong endorsement of the results, you will need representatives of these different functional owners to take part. Enough representation to build a “wide enough” business view, but not so much as to bring the impression of a fully democratic exercise. The functional representation is there to bring insight into relevant areas of the business, not necessarily to pass judgement on the whole spectrum of activities.

Calibre of resources. The qualities of the resources could be summarized as: motivated, capable, respected, possessing a broad knowledge and impartiality. Do the best that you can in ‘borrowing’ resources.

2. Map and understand the projects

The objective here is to make more sense of the project portfolio prior to ranking. The value is in the discussion for the core team, building an understanding how the initiatives create value for the business, their timing, mutual relationships and how they impact across the business.

The precise approach taken will vary somewhat depending on the nature of the precise question being asked and the stakeholders involved e.g. involving the whole business vs. only the product related functions. Some thoughts on potential candidates to include in mapping:

|

Project Value |

Project Investment |

|||||||||||||

|

Market risk |

Technology Risk |

|||||||||||||

|

Current project timelines |

Future projects pipeline |

|||||||||||||

|

Independent projects |

Projects with dependencies |

Mutually exclusive project options |

||||||||||||

|

Project duration |

Resources involved |

# Independent teams involved |

# New assets created (or types of assets created) |

|||||||||||

|

Product type architecture e.g. |

Market type architecture e.g. |

|||||||||||||

|

Core plat-form |

Messag-ing /CRM |

Scale data support |

Customised visualisations

|

Professional Services tools |

Core product platform |

Customisation enablers |

EMEA projects |

APAC projects |

NAM Projects |

|||||

A couple of project maps to show how visualisation can help understanding:

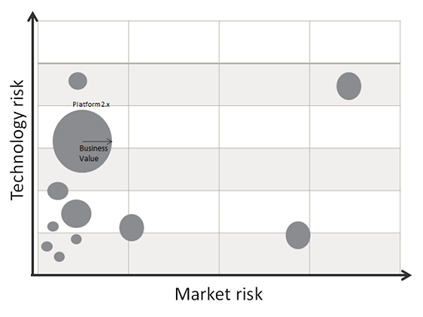

Value vs. Technology risk and Market risk map.

This is a good method to test the rationality and balance of the project approach against the market opportunity. It captures the business value of projects by the radius of the bubbles, so the most valuable projects stand out.

But it is sometimes hard to give every project a business value. An alternate view is to use project investment to scale the bubble radius.

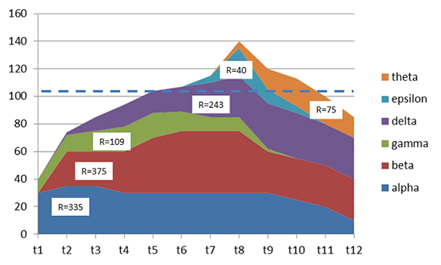

Projects resource/investment vs. timeline map.

This is a good method for seeing the relative and cumulative project resource in use on deliveries now as well as the anticipated future commitments. It is a useful view for testing portfolio “options”, although with future project estimation a challenge, project categories or templates maybe necessary.

3. Interpret strategy to build a prioritisation framework

The business strategy should provide clear guidelines as to what is important to the business, both now and for a few years into the future. Thus for prioritisation of projects/initiatives, strategic alignment is a key criterion. However, strategy alignment can be captured through a variety of measures, so general guidelines for the prioritisation framework include:

|

Clear meaning for individual criteria |

Readily understood by all of the core team |

|

Independent criteria |

Cover clearly separate issues |

|

Criteria have different priorities |

Some criteria clearly more important in prioritisation |

|

Individual criterion has “values” |

Enables ranking on 1 criterion (even if high/mid/low) |

|

Enough elements as necessary |

But as few as possible to avoid fatigue with large portfolio |

It is especially important that core team members representing the business function stakeholders are fully understanding and supportive of the framework selected.

4. Issues in trial ranking of projects

Fatigue. Large portfolios take time to discuss and must be split over several sessions. Ideally this happens over consecutive days to maintain a consistent “mind set” for the work. Energy is needed to combat fatigue, so the project content should be ordered so that the most relevant (however judged) projects are dealt with first, creating high value and building confidence in the approach.

Maintaining Cadence. Within sessions, it can be useful to “time box” individual project discussions and place those projects that lack conclusion into an open category. If many projects keep getting put in the open category then this can be a sign of:

- Low quality project descriptions

- Too complex prioritisation framework

- Too many people participating

The project lead can directly address the last two issues e.g. by opening up the framework or using a smaller size team to build the draft proposal & review with the wider core team.

Handling “open” category projects. The lead should judge if it is worth investing more time to clarify “open” projects/ priorities or to prepare to return such projects without overall priority but within some identifying category e.g.

- Projects lacking in description/benefits

- Projects lacking agreement on business priority

Rationality and balance of the result. The trial project rank result should appear to make sense logically. If there are some anomalies, then it is worth rechecking for consistency of prioritisation criteria. The other test which is less obvious is to look for balance using the earlier project mapping. If only the top 25% of projects are considered, what would the portfolio then look like when mapped? This approach picks up cases when there is not enough in effort anticipating future problems e.g. paying back technical debt.

5. Preparing for the senior stakeholder review

The ultimate approach taken for the review depends on the nature of the original question asked and therefore if any explicit decisions are required. The normal recommendations apply e.g. gaining feedback when possible from impacted functions, ensuring issues have solutions for mitigation and that the consequences for decisions are outlined.

It is important to be able to briefly show the “workings” how the team came to its proposal e.g.

- This is the issue e.g. project portfolio load unsustainable

- Here are the people / functions engaged in this activity to address the issue

- Here is the prioritisation methodology used

- And here are the conclusions & key decisions…

The visualisations built used for initially understanding the project portfolio are very valuable as a way of communicating the consequences of different options.